Every second counts when you’re making a quick payment. Whether it’s grabbing a coffee or paying for a ride, entering a PIN for small-ticket transactions can feel like an unnecessary friction.

The product team at Paytm identified this challenge and introduced UPI Lite—a feature designed to streamline low-value payments, enhancing both convenience and user experience.

The product manager and the team are featured as one of Upraised's top 50 Game Changers in 2024.

The Problem: Entering PIN for Small Ticket Transactions is a Hassle

The product team at Paytm has identified that approximately 70% of them fall into the small-ticket category—payments under ₹500. However, customers frequently encountered:

- Time Delays: Entering a PIN for every transaction, no matter how small, added friction to the payment process. And it takes a few seconds to a minute for validation and to complete the transaction.

- Interrupted Flow: PIN prompts disrupted the quick, seamless experience users expect, especially for frequent, low-value payments.

This led to a clear need for a solution that could make small-ticket transactions faster and more convenient while maintaining security and reliability.

The Solution: UPI Lite for PIN-less Payments

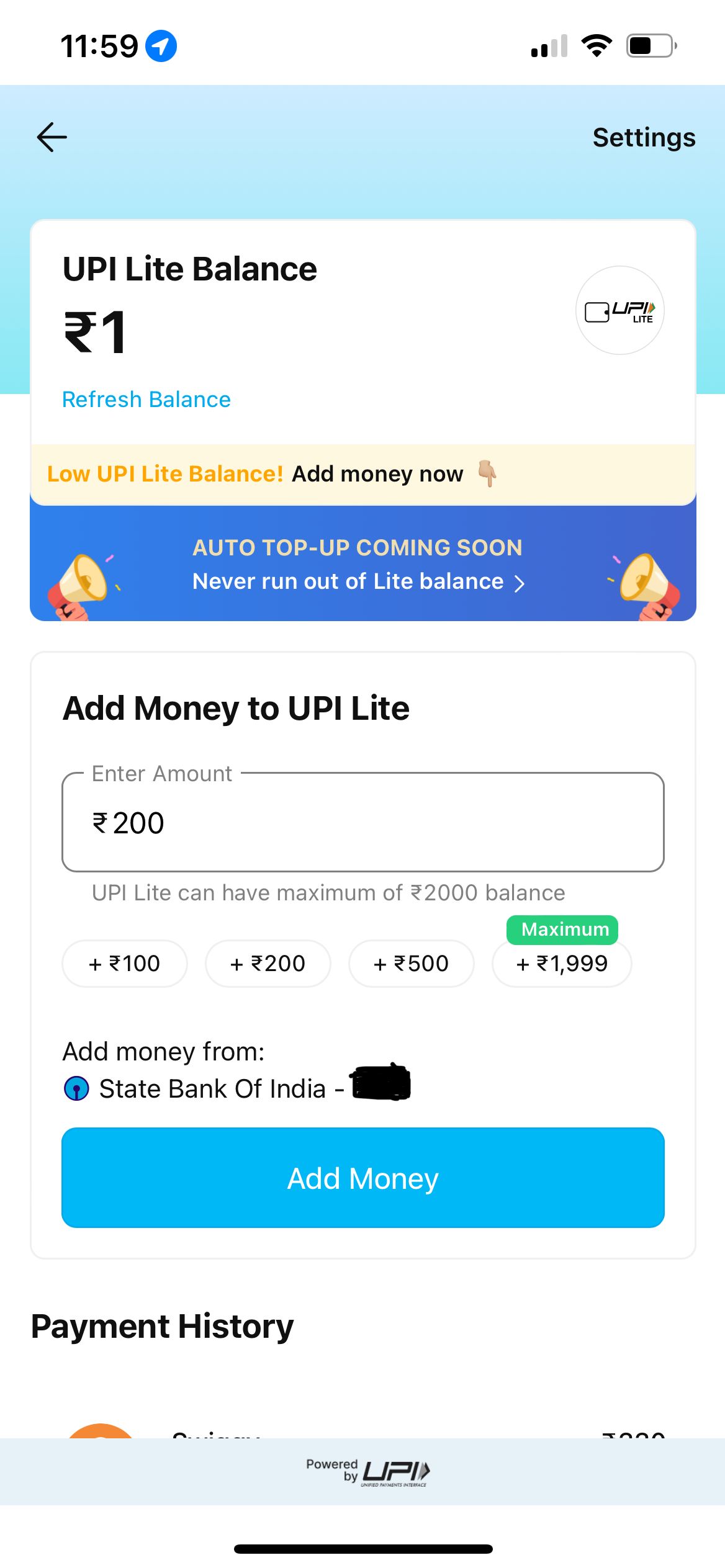

To address these issues, Paytm’s product team introduced UPI Lite, enabling customers to make PIN-less payments for transactions up to ₹500.

Key Features of UPI Lite

PIN-less Transactions: Users can make payments up to ₹500 without entering a PIN, ensuring faster and smoother transactions.

Seamless Integration: UPI Lite works seamlessly within the existing Paytm app, providing an integrated experience for all payment types.

Enhanced Convenience: Ideal for frequent small-ticket transactions, such as paying for snacks, rides, or groceries, UPI Lite removes unnecessary steps, saving time for users.

Secure and Reliable: Built on UPI’s robust framework, UPI Lite ensures security and reliability, even for PIN-less transactions.

Impact: Boosting Retention and Convenience

Since the implementation of UPI Lite, the product management team at Paytm has observed that it delivered measurable benefits to its users and the company:

- Increased Platform Retention: UPI Lite contributed to a 1.5% improvement in platform retention, as users enjoyed the simplified payment experience.

- Improved User Convenience: By eliminating PIN prompts for low-value payments, it has made small-ticket transactions faster and more user-friendly, encouraging repeat usage.

The Team Behind UPI Lite

Smritinjoy Das: Group Product Manager, Paytm Payments Bank

Post the discontinuation of Paytm Wallet, users could only use UPI for transacting. Smritinjoy & his team wanted to introduce an easier way to make frequent micro-transactions without putting the UPI PIN. Thus they introduced UPI Lite, which allows users to pay in one click with a daily limit of INR 4000, elevating convenience in the day-to-day lives of users.

As a part of Upraised’s Game Changers, we're on a mission to celebrate high-impact problem solving & celebrate the individuals who brought these innovations to life.

If you're reading this, you're most likely interested in the product space. At Upraised, we help people break into Product Management and grow to Senior Product Managers (SPM) at one-tenth the cost of an MBA and without quitting your job.