Managing personal finances often feels like solving a puzzle with missing pieces. Investments are spread across mutual funds, stocks, fixed deposits, real estate, loans, and credit cards, making it difficult to get a single, unified view of financial health.

The most fundamental question remains unanswered:

Where is my money?

Without a clear answer, financial planning becomes overwhelming, leading to poor decisions, missed opportunities, and financial anxiety.

The product manager and the team are featured as one of Upraised's top 50 Game Changers in 2024.

The Problem: A Fragmented Financial View

People today use multiple platforms for managing their wealth:

- Bank accounts for savings

- Trading apps for stocks and mutual funds

- Loan accounts for liabilities

- Credit cards with multiple due dates

- Property investments with no real-time valuation

With money scattered across different platforms, tracking net worth and making informed financial decisions becomes a tedious task. Financial clarity is missing.

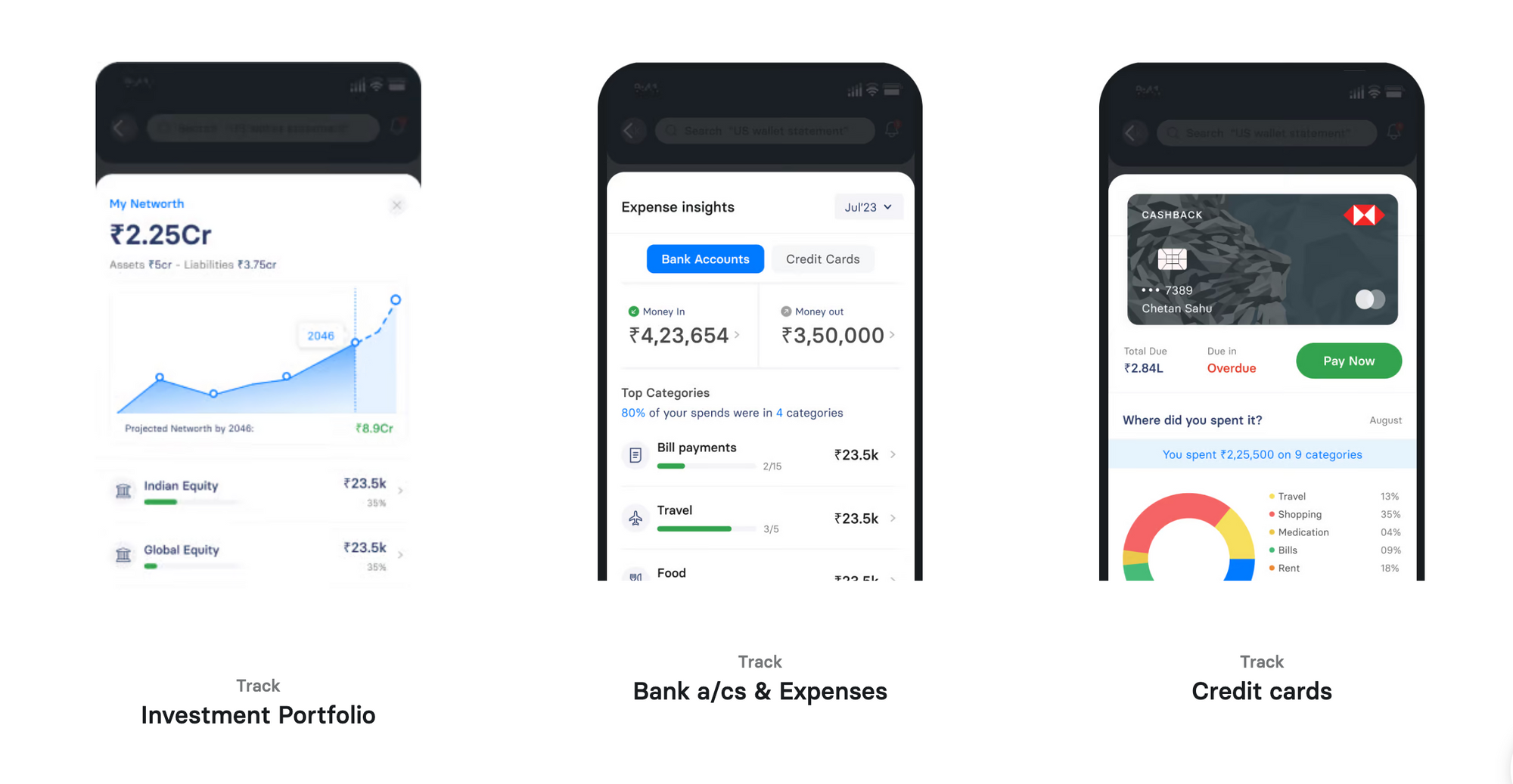

The Solution: INDmoney—Your Personal Balance Sheet

INDmoney solves the fragmentation problem by aggregating all personal assets and liabilities into a single financial dashboard.

- Track All Investments in One Place

Stocks, mutual funds, FDs, real estate, and more—view everything in real-time with automatic updates. - Monitor Your Liabilities

Stay on top of loans, credit card dues, and EMIs to ensure better debt management. - See Your Net Worth Instantly

INDmoney provides a picture of your wealth, just like a company's balance sheet, helping you make smarter financial moves. - AI-Powered Insights & Recommendations

INDmoney does more than track—it analyzes your financial health and offers personalized insights to optimize savings, reduce debt, and grow wealth.

Impact: Making INDmoney a Financial Companion

By aggregating all assets and liabilities in one place, INDmoney has created a powerful financial habit, increasing platform stickiness.

- Users return frequently to track their financial health

- Smarter decision-making with a complete view of net worth

- Higher engagement through personalized insights and recommendations

Team Behind This Feature

Mayank Misra- VP Product Management

Mayank and team noticed that people struggle to track their finances. With money spread across multiple accounts, investments, and loans, understanding net worth becomes a challenge. The team built a solution that automatically aggregates assets and liabilities into a real-time balance sheet.

As a part of Upraised’s Game Changers, we're on a mission to celebrate high-impact problem solving & celebrate the individuals who brought these innovations to life.

If you're reading this, you're most likely interested in the product space. At Upraised, we help people break into Product Management and grow to Senior Product Managers (SPM) at one-tenth the cost of an MBA and without quitting your job.