In the world of lending, the end product is money and for customers, the two biggest questions are always:

- How much loan can I get?

- What interest rate can I negotiate?

This leads to intense price-based competition among lenders, making differentiation a challenge. However, price wars are not a sustainable strategy. The real question is: How can a lending company add value to customers while maintaining pricing power?

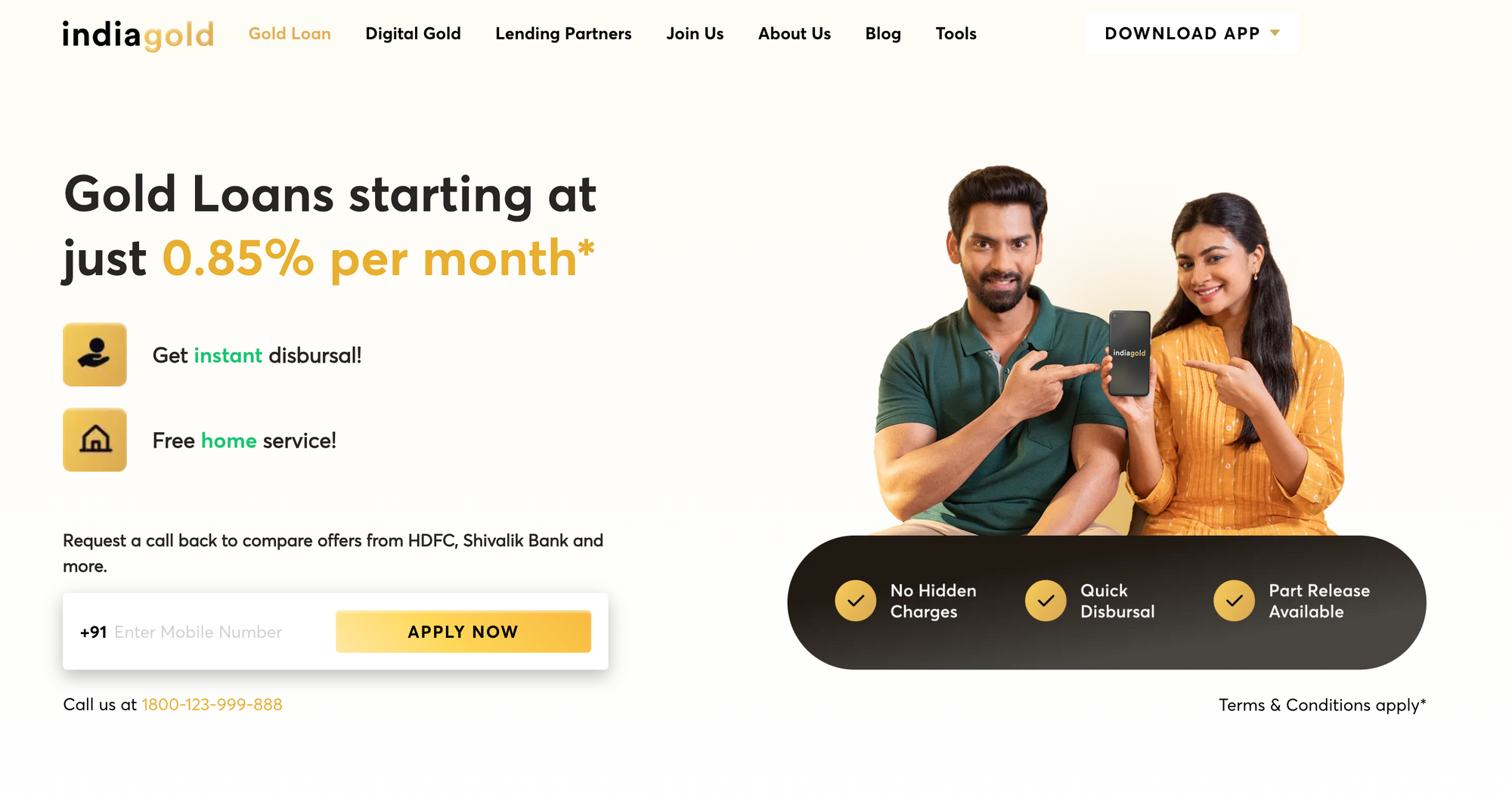

indiagold, answered this challenge by adding convenience to gold loans, changing them from a traditionally complicated process into a seamless, hyperlocal experience.

The product manager and the team are featured as Upraised's top 50 Game Changers in 2024.

The Problem: The Operational Complexity of Gold Loans

Gold loans are unlike other lending products. They come with significant operational hurdles, making them time-consuming and inconvenient for customers:

- Borrowers need to physically visit a branch, carrying valuable gold with them.

- The process involves lengthy safety, regulatory, and compliance procedures.

- Traditional lenders operate branch-based models, limiting accessibility and flexibility.

For a customer looking for a quick and secure loan, this creates unnecessary friction.

The Solution: Doorstep Gold Loans—Bringing the Branch to the Customer

To disrupt traditional lending models, our team of product managers, strategists, and engineers built a complex hyperlocal system that makes taking a gold loan as easy as ordering from Blinkit or Zepto.

1. A Seamless, 10-Minute Banking Infrastructure

We reimagined the lending experience by enabling doorstep gold loans—where a loan manager comes to the customer's home, assays the gold, and disburses the loan instantly. Achieving this required building:

- Branchless Core Banking: A fully digital system enabling real-time loan approvals and disbursements.

- Operational Tracking: A hyperlocal dispatch mechanism to allocate loan managers efficiently.

- Integrated Assaying & Approval Systems: Ensuring instant verification and compliance at the customer’s doorstep.

- Partner Bank Integrations: Seamless connections with financial institutions to enable real-time loan processing.

2. The Impact: Disrupting Traditional Lending Models

For borrowers, the transformation is simple yet powerful:

- No more branch visits—get a gold loan from the comfort of home.

- Faster, safer, and hassle-free process.

- Trust & transparency with real-time gold valuation and instant disbursement.

The Team Behind the Feature

Ravish Bhatia-Head of Products

Ravish noticed that gold loans were slow and inconvenient. Visiting a branch, waiting for approvals, and carrying gold made the process tedious. The indiagold's team changed that by bringing gold loans to the doorstep. He created process where a loan manager comes to a consumer, assesses the gold, and disburses the loan- all from the comfort of the consumer's home.

As a part of Upraised’s Game Changers, we're on a mission to celebrate high-impact problem solving & celebrate the individuals who brought these innovations to life.

If you're reading this, you're most likely interested in the product space. At Upraised, we help people break into Product Management and grow to Senior Product Managers (SPM) at one-tenth the cost of an MBA and without quitting your job.